The Single Strategy To Use For Custom Private Equity Asset Managers

Wiki Article

What Does Custom Private Equity Asset Managers Mean?

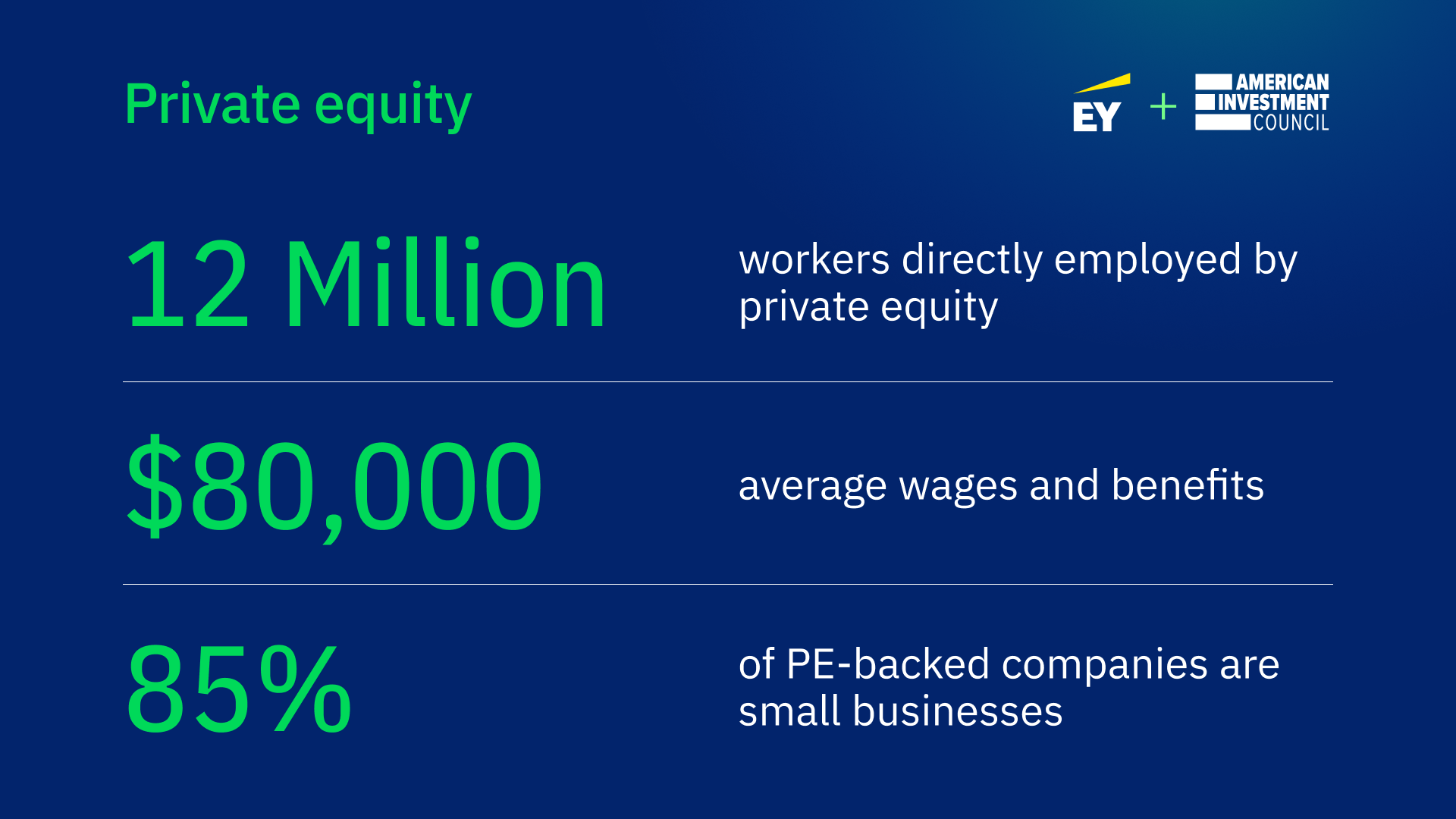

(PE): investing in firms that are not openly traded. Approximately $11 (https://custom-private-equity-asset-managers.webflow.io/). There might be a few things you don't comprehend about the market.

Partners at PE firms raise funds and manage the cash to generate desirable returns for shareholders, commonly with an financial investment horizon of in between four and 7 years. Exclusive equity firms have a range of investment choices. Some are strict financiers or passive investors wholly based on management to grow the company and generate returns.

Because the most effective gravitate towards the larger bargains, the center market is a considerably underserved market. There are much more vendors than there are extremely experienced and well-positioned financing professionals with considerable customer networks and sources to manage a bargain. The returns of private equity are generally seen after a few years.

Custom Private Equity Asset Managers for Beginners

Flying listed below the radar of large international corporations, much of these little firms usually give higher-quality client service and/or niche product or services that are not being supplied by the large empires (https://pubhtml5.com/homepage/mzmjd/). Such upsides bring in the rate of interest of private equity firms, as they have the understandings and smart to exploit such possibilities and take the business to the next level

Many supervisors at portfolio firms are given equity and incentive payment structures that award them for striking their financial targets. Exclusive equity chances are usually out of reach for people who can not invest millions of dollars, but they shouldn't be.

There are policies, such as limitations on the aggregate amount of money and on the number of non-accredited investors (Private Asset Managers in Texas).

The 15-Second Trick For Custom Private Equity Asset Managers

An additional downside is the lack of liquidity; as soon as in an exclusive equity deal, it is difficult to obtain out of or market. There is a lack of flexibility. Exclusive equity also features high fees. With funds under management currently in the trillions, private equity firms have actually ended up being attractive financial investment lorries for affluent people and establishments.

For years, the qualities of personal equity have made the property course an attractive proposition for those that can participate. Currently that access to private equity is opening as much as even more individual financiers, the untapped potential is ending up being a reality. So the concern to take into consideration is: why should you invest? We'll begin with the major debates for investing in personal equity: Just how and why exclusive equity returns have traditionally been greater than various other assets on a number of levels, Exactly how including private equity in a portfolio influences the risk-return account, by helping to expand versus market and intermittent threat, Then, we will outline some vital considerations and risks for private equity capitalists.

When it involves presenting a new possession into a profile, the a lot of standard factor to consider is the risk-return account of that asset. Historically, private equity has actually displayed returns similar to that of Arising Market Equities and greater than all various other standard asset classes. Its reasonably reduced volatility combined with its high returns produces a compelling risk-return account.

How Custom Private Equity Asset Managers can Save You Time, Stress, and Money.

In reality, personal equity fund quartiles have the largest variety of returns throughout all alternative property classes - as you can see listed below. Method: Inner rate of return (IRR) spreads out calculated for funds within vintage years independently and afterwards balanced out. Median IRR was determined bytaking the average of the average IRR for funds within each vintage year.

The takeaway is that fund option is critical. At Moonfare, we accomplish a strict option and due diligence procedure for all funds provided on the platform. The effect of including personal equity right into a portfolio is - as always - depending on the portfolio itself. However, a Pantheon research from 2015 recommended that including private equity in a portfolio of pure public equity can open 3.

On the other hand, the most effective personal equity companies have accessibility to an even bigger pool of unknown opportunities that do not encounter the very same scrutiny, as well as the sources to execute due persistance on them and recognize which are worth spending in (Private Investment Opportunities). Spending at the ground floor implies higher risk, however, for the companies that do succeed, the fund take advantage of higher returns

Custom Private Equity Asset Managers Fundamentals Explained

Both public and exclusive equity fund managers commit to investing a portion of the fund but there stays a well-trodden problem with lining up rate of interests for public equity fund administration: the 'principal-agent issue'. When a financier (the 'major') works with a public fund supervisor to take control of their resources (as an 'agent') they hand over control to the supervisor while preserving ownership of the possessions.

look what i foundIn the situation of personal equity, the General Partner does not just make an administration fee. Exclusive equity funds also reduce one more type of principal-agent issue.

A public equity capitalist eventually wants one thing - for the management to enhance the supply cost and/or pay returns. The financier has little to no control over the choice. We showed over the amount of exclusive equity techniques - particularly majority buyouts - take control of the operating of the firm, making certain that the long-lasting worth of the firm comes initially, raising the return on financial investment over the life of the fund.

Report this wiki page